Connect with us

Hi, what are you looking for?

Stocks

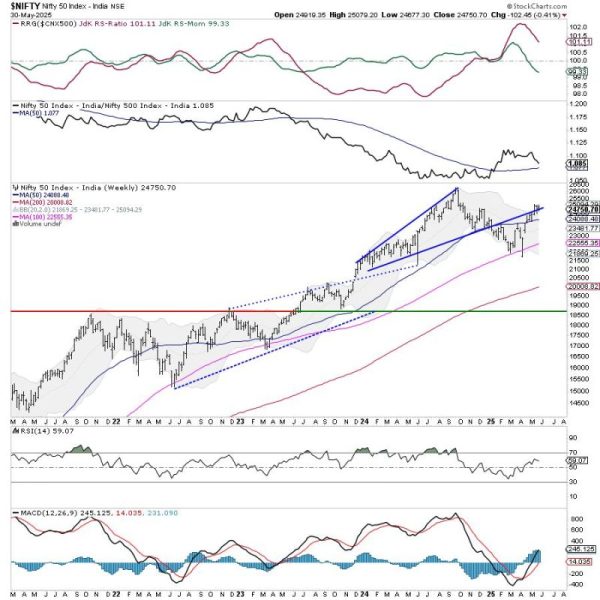

Over the past five sessions, the Indian equity markets headed nowhere and continued consolidating in a defined range. In the previous weekly note, it...