The data that the CFTC publishes in its weekly Commitment of Traders (COT) Report tell us about the positioning of the different types of traders that they track. That can provide useful sentiment indications for a variety of futures markets, if interpreted correctly. This week, I look at how the COT data on Bitcoin futures go against how things normally work.

The “commercial” traders are the ones who use the subject commodity in their trade or business. Usually, they are the smart money. The “non-commercial” traders are the large speculators — think hedge funds. And the “non-reportable” traders are ones whose positions are so small that the CFTC figures they are not worth bothering to track individually.

As mentioned, in most futures contracts, it is the commercial traders who are the “smart money.” But in Bitcoin, things work differently. There, it is the large speculators who are the smart money, most of the time. The COT Report data on Bitcoin futures only go back to 2018, so there is not a lot of history on this topic.

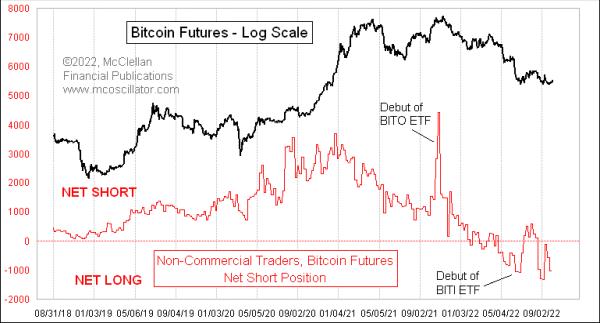

The chart above shows that the non-commercials’ net position as a group is positively correlated with the Bitcoin price action. And when they get to a big skewed position, that tends to matter as a sentiment reading for Bitcoin prices. These traders have been net long since earlier this summer, evidently expecting a bounce to come for Bitcoin prices.

It is a rather fascinating, but not surprising, historical oddity that Bitcoin prices peaked with the debut of the BITO ETF, which allows you to hold a Bitcoin proxy in your brokerage account. And the week that the inverse ETF BITI was opened for trading marked the bottom.

By contrast to the large speculators, the commercial traders’ net position in Bitcoin futures is inversely correlated with Bitcoin prices. The normally smart money crowd seems to be quite horrible at knowing what prices are going to do.

During some of the history of the COT data, there have been periods when there were zero contracts held by the commercials. We do not know what the characterizations that the CFTC has chosen to make about the commercial traders of Bitcoin futures are, but we can say that these traders do not seem to be very prescient about what Bitcoin prices are going to do.

There is a new product just out for those wanting to play with Bitcoin futures. The Micro Bitcoin futures contract is worth 1/10 the amount of the big one, and it has been rapidly gaining a following among traders. And, as with the big Bitcoin contract, it appears that it is the non-commercial traders who are the smart money, although that was arguably not the case in the first few weeks of its trading back in mid-2021.

The bottom chart shows the net position of those non-commercial traders in the Micro contract, and what I find noteworthy is the rapid move toward an even bigger net long position that they have been undertaking in the past 8 weeks, and that is with Bitcoin prices mostly going sideways during that time. So one cannot say that this position change is price-induced; they are moving further to the long side based on no price action. Evidently they know something, or think that they do. History suggests that this will be a bullish development for Bitcoin prices, eventually.