The technology group Dyson has paid a £1.2bn dividend to the Singapore-based family holding company of its founder.

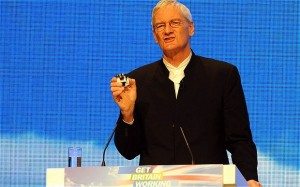

The pro-Brexit entrepreneur Sir James Dyson moved the group’s corporate headquarters to the city state in 2019, attributing the decision to the growing importance of supply chains and customers in Asia.

Filings published in Singapore’s corporate registry reveal details of the subsequent performance of the business, which was founded in Wiltshire in 1991 and famed for its vacuum cleaners, hand-dryers and fans. The accounts showed Dyson Holdings revenues increased from £6bn to £6.5bn between 2021 and 2022 but pre-tax profit fell from £1.2bn to £1bn, chiefly because of an increase of almost £600m in costs.

The accounts also showed a £1.2bn dividend was paid in 2022 to the parent company, Weybourne Holdings, which also owns the multibillionaire’s family office, Weybourne Group, and UK investments in land and insurance.

The dividend was up from £1bn in 2021 and took the total extracted by Dyson from his technology company to £4bn over the past five years, according to Bloomberg, which first reported the payout.

Together with his family, Dyson is listed as having a net worth of £23bn, according to the latest Sunday Times rich list, making him Britain’s fifth richest man.

Payouts to Weybourne Holdings have increased in recent years alongside a broader diversification of his business interests, including growing investments in agricultural land through his Dyson Farming venture.

Analysis last year, based on data from the UK’s new register of properties owned offshore, also revealed that Weybourne Holdings owned at least 31 UK properties, which Land Registry records indicated were worth at least £287m. The portfolio included London office blocks in Mayfair and Camden, a £43m strip of land on the Greenwich peninsula, and sites in York and Oxfordshire.

Dyson Farming, the Dyson Group and an insurance business called Alpinia are all housed within Weybourne Group, which also manages the billionaire’s philanthropic organisation, the James Dyson Foundation.

Dyson moved the headquarters of his home appliances business to Singapore in 2019, shortly afterwards spending £43m on a triplex penthouse in the city’s tallest building.

Although the company’s research and development operations remained in Malmesbury, Wiltshire, the overseas shift drew criticism, given that Dyson had previously touted Brexit as a great opportunity for UK entrepreneurs. His justified the decision by highlighting the need to access Asian markets close to Singapore. He backed up the rhetoric by opening a new headquarters there last year and pledging to invest more than £1bn.

The company has also revealed plans to build a new battery factory in Singapore, alongside investments in technology centres in the UK and the Philippines.

Read more:

James Dyson paid £1.2bn dividend in 2022 by technology group