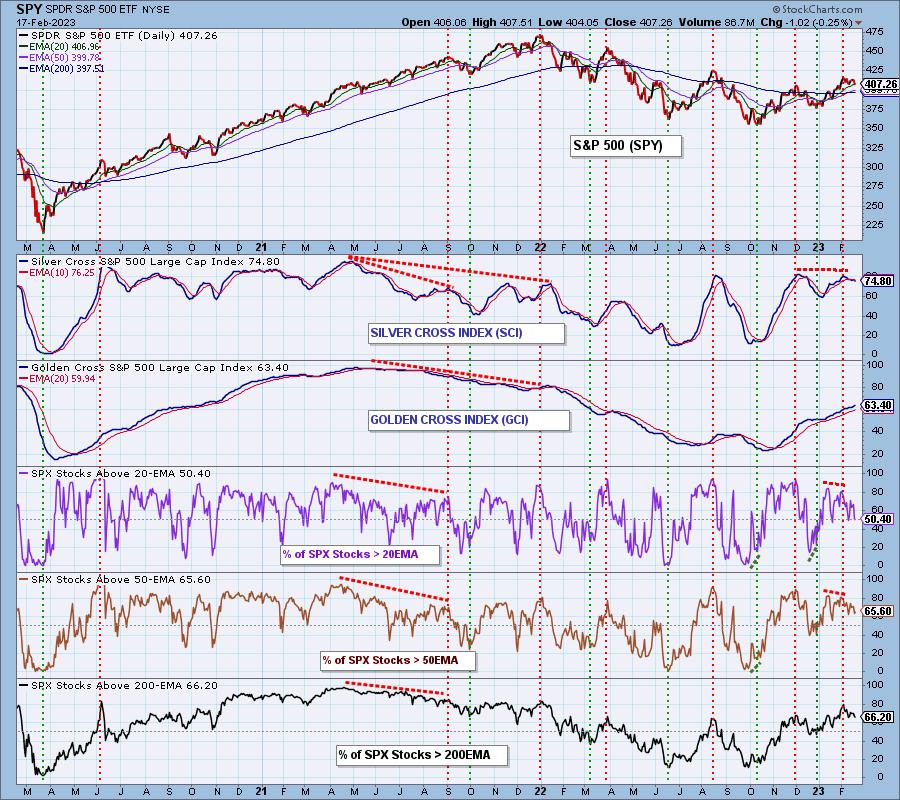

The market is currently topping because the Silver Cross Index (SCI), which expresses intermediate-term participation, is overbought and topping. A Silver Cross is when the 20EMA of a price index crosses up through the 50EMA. The Silver Cross Index shows the percentage of stocks in a market or sector index that have a made a Silver Cross. The SCI currently has a reading of 75 percent, having fallen from a top of about 80.

On the chart below we also have the source indicators for the Silver Cross Index. The Percent Stocks Above 20EMA reads 50 percent, and the Percent Stocks Above 50EMA reads 66 percent. If this configuration is maintained, the SCI will necessarily fall to about 66. Such a drop in participation will likely have a negative effect on price.

The Golden Cross Index (GCI) tracks the percentage of stocks in the index with a Golden Cross, which is when the 50EMA crosses up through the 200EMA. This is an expression of long-term participation. Currently the source indicators show the Percent Stocks Above 50EMA at 66 percent, and the Percent Stocks Above 200EMA at 66 percent. If this configuration is maintained, the GCI has no upside potential.

DecisionPoint tracks the Silver Cross and Golden Cross Indexes for 25 market indexes, sectors and industry groups, and we publish this table in the DecisionPoint ALERT weekly.

CONCLUSION: Deterioration of participation (the SCI) is likely to cause further price decay in the intermediate-term, which will likely see stalled long-term participation (the GCI) begin to decline as well.

Watch the latest episode of DecisionPoint on StockCharts TV’s YouTube channel here!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

DecisionPoint Chart Gallery

Trend Models

Price Momentum Oscillator (PMO)

On Balance Volume

Swenlin Trading Oscillators (STO-B and STO-V)

ITBM and ITVM

SCTR Ranking

Bear Market Rules

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action. Current