[T]he confidence in the unlimited power of science is only too often based on a false belief that the scientific method consists of a ready-made technique, or in imitating the form rather than the substance of scientific procedure, as if one needed only to follow some cooking recipes to solve all social problems.

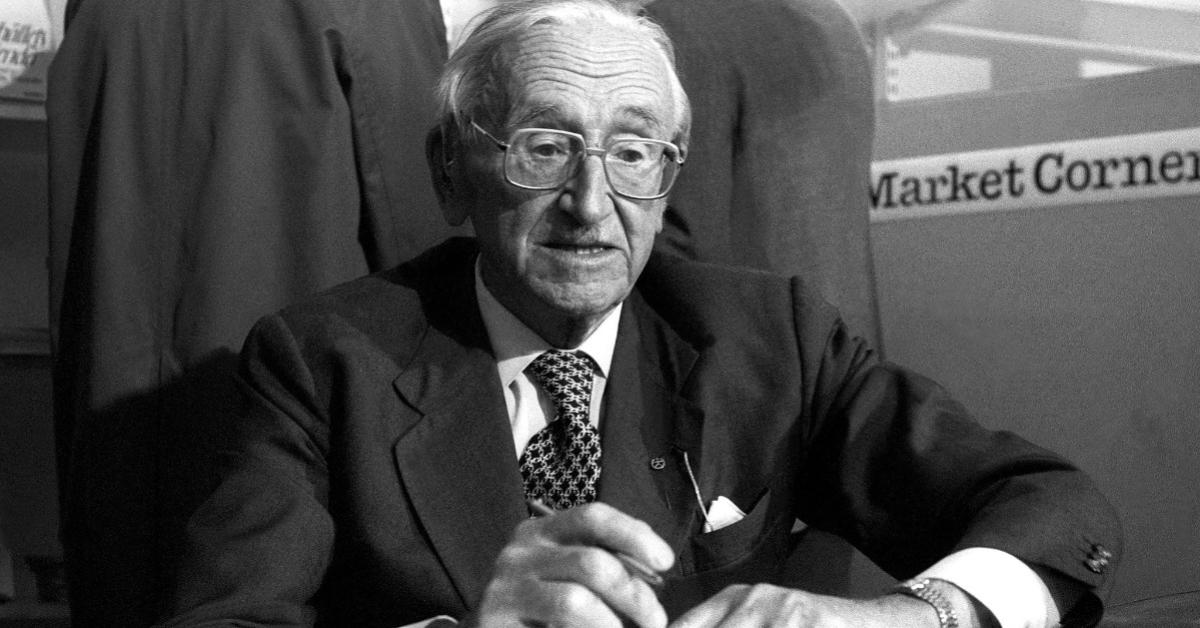

— Hayek, F. A., The Pretence of Knowledge, Lecture to the memory of Alfred Nobel, December 11, 1974.

It is a common practice among scientists who win the Nobel prize for some intellectual achievement to deliver their Nobel Prize lectures on another intellectual achievement that is in more need of attention. Such was the case with Albert Einstein, who won the Nobel prize in physics in 1921 “for his services to Theoretical Physics and especially for his discovery of the law of the photoelectric effect,” which celebrated his achievements in statistical and quantum mechanics, but who delivered a speech on the special theory of relativity, a controversial idea to many scientists at the time. Likewise, Friedrich August von Hayek has won the prize “for [his] pioneering work in the theory of money and economic fluctuations and for [his] penetrating analysis of the interdependence of economic, social, and institutional phenomena,” and has delivered his Nobel lecture on the abuse of reason in the social sciences.

Hayek is one of the last century’s great polymaths, with major contributions to economics, political philosophy, ethics, legal studies, and epistemology. His intellectual heritage survives in the Austrian school of economics and is alive and well today with journals and schools producing current research and training younger researchers in economics and the social sciences. His work on macroeconomics and monetary theory with Ludwig von Mises in their newly founded (1927) Austrian Institute of Economic Research has resulted in Hayek’s Monetary Theory and the Trade Cycle (1929), and Prices and Production (1931).

These two volumes, along with Mises’ Theory of Money and Credit (1912), form the basis of the modern Austrian Business Cycle Theory. The theory cemented Hayek as a major economist of the twentieth century. However, he gained international fame from his eerie volume, Road to Serfdom (1944), which warned of the totalitarian regimes that would come after the wake of the second world war. His analysis of the nature of social knowledge and its limit is perhaps what we most remember him for.

What is Knowledge?

In 1945, Hayek published one of the most cited papers in the field of economics on the nature of knowledge that may be used by individuals in making their decisions. His article, The Use of Knowledge in Society, has stressed that our actions as agents choosing between alternatives are not informed by facts and beliefs that can be produced when prompted, but by imitating behavior that successfully produces the desired results and by interacting with a world that is constantly changing.

A machine can hardly manage in dealing with a world in flux, but it comes perfectly naturally to us humans. As Descartes reminds us, “we can certainly conceive of a machine so constructed that it utters words corresponding to a change in its organs. But it is not conceivable that such a machine should produce arrangements of words so as to give an appropriately meaningful answer to whatever is said in its presence, as even the dullest of men can do.” (Cottingham, John, In Search of a Soul, Princeton University Press, 2020, p. 55.) And even with the advent of machine learning, artificial intelligence, and modern computers, human oversight is always needed since, ultimately, we generally do not accept that anyone (or anything) be held accountable for the risks and choices we relegate to others.

Hayek observes that humans do not become proper citizens by being taught how to act, but by carefully following practiced traditions and responding to external stimuli. (Hayek, F.A., The Fatal Conceit, University of Chicago Press, 1988, pp. 19 – 28.) Thomas Sowell’s Knowledge and Decisions (1980), chiefly inspired by Hayek’s article, has incorporated this idea into the realms of sociology, psychology, and public policy, showing the idea’s breadth of scope and the extent of its function and utility.

We may abstractly discuss the nature of knowledge, but our practices reflect another type of knowledge that can hardly be articulated. Prices function as facilitators of our limited knowledge regarding the skills and resources needed for any end we seek. And so, by responding to price signals as a mediator of our dispersed knowledge, we are able to navigate the choices we have and discriminate between them.

The Limitations of Science

In his article, The Pretence of Knowledge (1974), the author carefully stresses how misguided it was of economists to mindlessly emulate the methods of the physical sciences. This approach wherein researchers in the social sciences use forecasting and attempt to explain prices has been dubbed scientistic (a pejorative term), due to its use of sophisticated schemes that produce errors caused by the misuse of data and accepting the results of mathematical analyses at face value regardless of their assumptions. Hayek’s explanation of this error, which is reminiscent of the Streetlight Effect (often called the McNamara Effect), cast doubt on the increasingly theoretical direction modern economics has taken to its detriment. This clarification of the abuse of statistics and mathematics has notified many social researchers of the limitations and failures of pseudoscientific practices when the methods adopted from the physical sciences are twisted and stretched beyond their area of applicability.

But Hayek had another, important reason, for exploring these issues. Science has often been used to implement government interventions that diminish people’s freedoms and imposes arbitrary control over their decisions. Ludwig von Mises, Hayek’s postdoctoral mentor, has discussed in previous articles (1. Mises, L. H. E., Profit and Loss, lecture presented to the Mont Pèlerin Society held in Beauvallon, France, September 9 to 16, 1951. || 2. Mises, L. H. E., Economic Calculation in the Socialist Commonwealth, Archiv für Sozialwissenschaften 47, 1920.) the operating mechanisms of the market and the impossibility of the central management of society into prosperity.

The torch of liberty has been carried by Mises’ students afterward; the three most notable students were Israel Kirzner, Murray Rothbard, and the object of this article, Friedrich von Hayek. Unless this issue has been addressed, science will always be abused by positions of authority. Hayek ends his Pretence of Knowledge with a warning:

The recognition of the insuperable limits to his knowledge ought indeed to teach the student of society a lesson of humility which should guard him against becoming an accomplice in men’s fatal striving to control society—a striving which makes him not only a tyrant over his fellows, but which may well make him the destroyer of a civilization which no brain has designed but which has grown from the free efforts of millions of individuals.

Wisdom and prudence may well advise us to pay attention to these cautionary words.