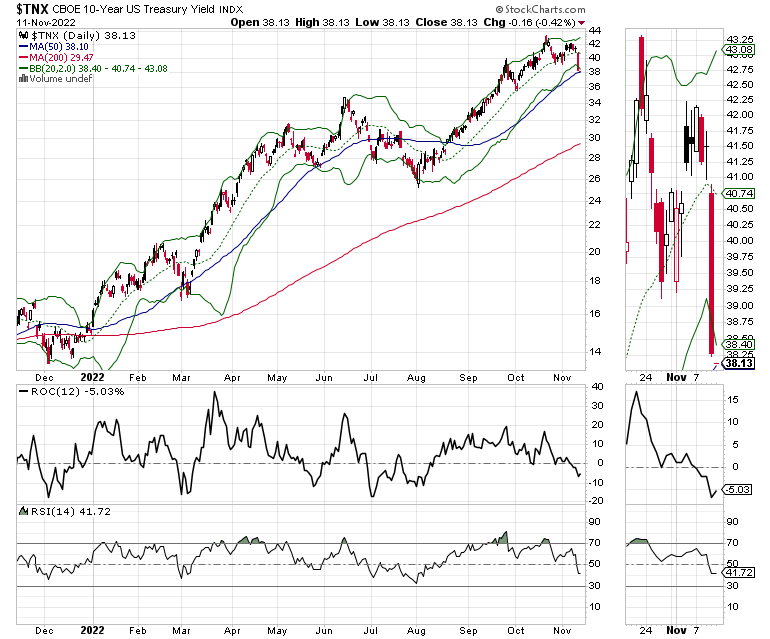

Financial markets hate higher interest rates and uncertainty above everything else. And now that the election is mostly past, the market is refocusing on the Federal Reserve, inflation and the future of interest rates.

I don’t want to get into a political discussion. But let’s just say that the GOP’s underwhelming performance pulled the rug out from the algos who believed all the hype about the so called Red Wave.

That didn’t last, though, since algos and gnats have the same attention span. So, the cooler-than-expected CPI brought the bulls back as, you guessed it, now the Fed is expected to “pivot,” yet again. Meanwhile, the market’s breadth keeps improving as short sellers continue to get scalped. Maybe we’ll get that Santa Claus rally after all. Do algos believe in Santa?

We’ll see how long this rally lasts.

Capitulation Lurks as Homebuilders Shrug Off “Bad” Earnings as Flippers Drown in Red Ink

Last week in this space, I noted: “in order to avoid confusion, it’s best to trade what we see. That means there is only one way to operate in this market. If an open position works, stick with it.”

A perfect example is what happened on 11/9/2022 when D.R. Horton (DHI) “missed” the market’s expectations on its earnings and revenues and the stock rallied, most likely based on the company’s chairman, Donald R. Horton, and his comments regarding demographics and housing supply.

To paraphrase, Mr. Norton noted that both were in the company’s favor at the moment, especially when they are sitting on nearly $2 billion worth of cash on their balance sheet to go along with a manageable inventory of homes and a bevy of buildable lots which can be sprung into action quickly.

The following day, when bond yields crashed after the CPI, the housing stocks hit the afterburner.

Of course, Mr. Horton remains rightly concerned about the Fed’s war on homebuilders, noting that DHI saw a 36% contract cancellation rate in its most recent quarter to go along with a decrease in orders due to the rise in mortgage rates.

But here is why I like the homebuilders. DHI is “struggling” at the moment, at least if you believe the generally reported news about falling home sales and rising mortgage rates. Yet, while analysts registered a miss in their expectations, the company still delivered $9.64 billion in revenues while beating earnings expectations by nearly 4% due to cost-cutting and smart inventory and pricing management. That’s the kind of revenue miss I could handle without any trouble.

Correct me if I’m wrong, but I’m thinking that a company which is trading at below 5 times earnings, and can deliver nearly $10 billion in revenues in what analysts call a soft quarter, is fairly likely to blow estimates out of the water when the good times return.

I guess I’m not alone, as the stock rallied on rising volume as investors focused on the macro factors that matter most over the long term. The migration to the sunbelt is likely to increase as a result of the election and the general state of the job market in the U.S.

Don’t misunderstand me. The U.S. economy is clearly softening, and the housing sector is clearly less robust compared to where it was just a few months ago. And of course, the market could easily reverse course on a dime. But it’s hard to argue with the fact that, on the same day as Horton’s earnings, online realtor/flipper Redfin noted it was laying off 13% of its workforce. Most of the cuts are in their home-flipping division RedfinNow, as their sales have plummeted while the company overpaid for most of their homes.

Even more interesting, and highly applicable to DHI and the other homebuilders, Redfin’s CEO told his employees that the company has tied up “hundreds of millions of dollars in houses that you yourself wouldn’t want to own right now.” In other words, the homes for which they overpaid based on their algorithms, not human eyes and property assessments, are money losers. They also bought them at the top of the market, in hopes of flipping them for a profit. Sadly many were in such sad shape that the amount of money required to upgrade them can’t be justified by what they would be able to get for them in the current market.

What I’m saying is that Redfin’s problems, along with Zillow’s before them, are suggestive of capitulation and corporate panic primarily due to shoddy business practices and overreliance on artificial intelligence.

The bottom line is that in this market, many existing homes aren’t as attractive as new homes because flippers can’t afford to spruce them up. All of which explains why, even when homebuilders miss estimates, their numbers are still good enough to move their shares higher.

I own shares in DHI.

Welcome to the Edge of Chaos:

“The edge of chaos is a transition space between order and disorder that is hypothesized to exist within a wide variety of systems. This transition zone is a region of bounded instability that engenders a constant dynamic interplay between order and disorder.” – Complexity Labs

NYAD Shows Staying Power, Liquidity Remains Surprisingly Decent

The market’s breadth remains positive in the short term, while liquidity has stabilized. This supports the notion that the current rally could move higher for the next few weeks, barring something nasty like the Fed doing its best to derail it.

The New York State Advance Decline line (NYAD) has now crossed above its 50-day moving, and the CBOE Volatility Index (VIX) is now in a downtrend. When VIX falls, stocks tend to rally as selling pressure from market makers responding to put buyers fade away.

The Eurodollar Index (XED) moved up last week, suggesting that at least a short-term liquidity burst is developing. XED has remained above 95, which is a small ray of sunshine peering through a vast cloud cover.

The S&P 500 (SPX) is well above its 50-day moving average and looks headed for a test of the 200-day moving average near 4100. Accumulation Distribution (ADI) has improved and On Balance Volume (OBV) is showing some small signs of improvement. Fingers crossed.

The Nasdaq 100 index (NDX) is still stuck between the 11,000-12,000 trading range and is way behind SPX in showing its willingness to recover. ADI and OBV here remain worse than in SPX, where the energy stocks are exerting some upward pressure.

To get the latest up-to-date information on options trading, check out Options Trading for Dummies, now in its 4th Edition – Get Your Copy Now! Now also available in Audible audiobook format!

#1 New Release on Options Trading!

Good news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 videos) and a few other favorites public. You can find them here.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe’s exclusive stock, option and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.