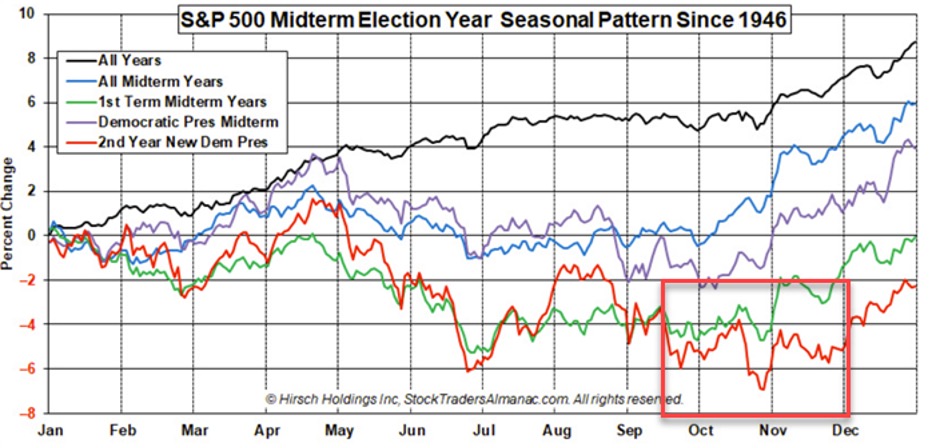

CHART 1: HOW’S THE S&P 500 INDEX? The S&P 500 Index is, so far, moving in line with past seasonal patterns.

Conventional wisdom is that the Democrats will retain the Senate and lose the House, but there’s a chance the Republicans could easily sweep both chambers. With the midterm elections tomorrow, it’s still too early to call the outcome of many of the races, and we may not know the result until late in the week once all absentee ballots are counted. In addition, any dissonance regarding the results could further rattle the market in an already volatile year.

The stock market tends to reward divided governance in Washington, and this year’s midterm elections may be no different. All 435 seats in the House of Representatives, along with 35 seats in the Senate, are up for grabs. While the stock market has outperformed when there’s been a divided government, the returns generated in the years following the same party controlling the Senate, the House, and the Presidency have been less positive.

Clearly, there’s still electoral uncertainty about these midterm elections, but past seasonality trends during midterm election years points to an anticipated bullish pattern. This year, however, may deviate from the trend, as inflation and the possibility of recession loom large over this market.

This year’s elections may be more about the economic hardship being felt and which party voters believe is to blame or has the most potential to change their economic fortunes. Plus, there are large societal implications woven into the economic ones.

Inflation on the Ballot

The biggest issue voters are concerned with is inflation. Despite the Fed’s attempts to reverse inflation, looking at the silver market and the U.S. dollar, investors have more to worry about than who wins this week. In the past, the biggest inflationary moves occur when silver outperforms gold and while they both rise in price (see Chart 3).

CHART 3: SLV MOVING HIGHER. iShares Silver Trust (SLV) held major support at around $16 since July. On November 4, silver prices moved higher.

Silver’s price exploded on November 4, 2022. SLV has held major support at around $16 since July. If you go back to early October, you’ll see that the recent action shows price levels hitting some resistance. However, the more important takeaway from the chart is that the MarketGauge Leadership indicator shows silver outperforming gold. Plus, the MG Real Motion indicator, a measure of momentum, tells us that we’re not alone in the bullish bias.

Another key to the inflation worries is the U.S. dollar (see Chart 4).

CHART 4: THE U.S. DOLLAR TOOK A HIT AFTER THE FEDERAL RESERVE RAISED RATES.

Last week, the U.S. dollar took a hit in the face of the Federal Reserve’s fourth 75-basis point interest rate rise. Although a weaker dollar can point to a move into riskier assets and a sense the Federal Reserve will slow down the pace of rate raises, you should also look globally for other dollar headwinds.

While not on the ballot per se, the geopolitical issues facing the U.S. and the world cannot be discounted. China and the Middle East are also actively talking about moving away from Petrodollars and into Yuan, as per the BRICS meeting a few months ago.

The Leadership indicator shows the dollar now underperforming the S&P 500 Index ($SPX). It also shows a significant decline in momentum. That could be a positive for equities in the short term; nevertheless, it could fuel further concern for inflation in the intermediate to longer term.

Circling back to the consensus, if gridlock ensues, we expect to see very few economic policy changes. The existing economic policies should remain intact (China Trade Sanctions, Infrastructure investments, including clean energy, CHIPS and Science Act, Inflation Reduction Act) to name a few. It might be prudent to watch for investment opportunities in the areas both parties agree with, such as raising defense spending, supporting decentralized finance (DeFi), blockchain technologies, and sensible crypto regulations.

On the other hand, if Democrats retain control of Congress, clean energy will benefit, and blue-chip companies may prioritize returning cash to investors via dividends, since there could potentially be a buyback tax legislated.

To learn more about Mish’s trading service or how our Real Motion Trading Indicator and our TriplePlay Trading Indicator integrate on platforms like StockCharts, Fidelity, and TradeStation, you can sign up for a consultation with Rob Quinn, our Chief Strategy Consultant, here.

Rob can also give pricing and software compatibility info. over a 10-minute call or quick video chat via a one-to-one complementary trading consult.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth. Grow Your Wealth Today and Plant Your Money Tree!

“I grew my money tree and so can you!” – Mish Schneider

Mish Schneider

MarketGauge.com

Director of Trading Research and Education