Every Friday during the DecisionPoint Diamond Mine trading room for DP Diamonds subscribers only, we do an in-depth look at all of the sectors and choose a “Sector to Watch” that could see positive results the following week. We then dive into that sector and find an “Industry Group to Watch”, as well as a few symbols that have potential.

I decided to reprint a portion of today’s DecisionPoint Diamonds Recap, in which I review the top “Diamond in the Rough” of the ten selected during the week, as well as the “Dud” of the week. I also review the RRGs and post the DP Sector Scoreboard. I’m only including the sections on “Sector & Industry Groups to Watch” here.

(You may not know this, but we now host “ETF Day” on Wednesdays, where I select three ETFs that should ride the tide of current market conditions, because not everyone likes to trade stocks.

The Friday hour-and-a-half Diamond Mine allows for all symbol requests to be reviewed and real-time discovery of the “Sector to Watch” and “Industry Group to Watch”. I also reinforce the DecisionPoint trading strategy that I’ve created over the past two years. If you’d like to try out this report and the DP Alert, use Coupon Code: SAVE50 and get 50% off your first month of any DecisionPoint.com subscription.

<drum roll> And, this week’s sector and industry group to watch are…

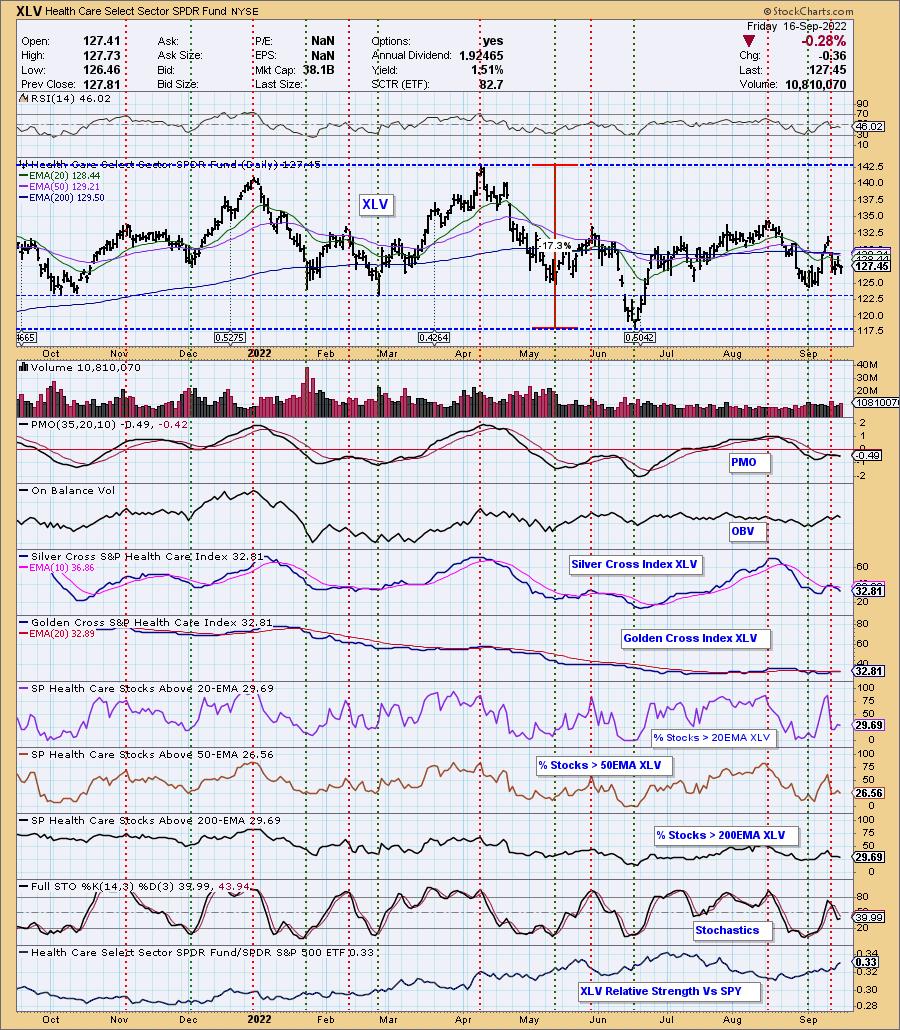

Sector to Watch: Healthcare (XLV)

While XLV hasn’t had an easy time, none of the sectors have. Choosing the Sector to Watch was challenging, given that one of the sectors carry positive momentum. It came down to outperformance against the SPY and participation readings not deteriorating further today.

Not surprisingly, there are problems on this chart. The RSI is negative and has topped. The PMO topped and moved into a whipsaw SELL signal. It hasn’t been able to recapture the signal line, but at least the margin is very thin. Stochastics actually twitched up. %Stocks indicators are lower than the Silver Cross Index (SCI) and Golden Cross Index (GCI), meaning this is far from an improving chart. Most of the industry groups aren’t fairing well, but one does have some promise…

Save 50% off your first month of any of our newsletters by using coupon code: SAVE50

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

DecisionPoint Chart Gallery

Trend Models

Price Momentum Oscillator (PMO)

On Balance Volume

Swenlin Trading Oscillators (STO-B and STO-V)

ITBM and ITVM

SCTR Ranking

Bear Market Rules

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Industry Group to Watch: Pharmaceuticals ($DJUSPR)

Not a pretty chart either, but it does have some bullish characteristics. The RSI is negative, but gently rising. The PMO is on a rather new crossover BUY signal. Stochastics have turned up, volume is coming in strong, and it’s increasing its outperformance of the SPY. It is in a declining trend still, but support is holding at the June low. I’m not suggesting you should buy, but there were a few symbols that I found interesting in the Diamond Mine this morning: Bristol-Meyers (BMY), Johnson & Johnson (JNJ) and Merck (MRK).

Go to StockCharts.com you can find the Industry Summary. Our sector charts are available to all subscribers.

Have a great weekend! Good Luck & Good Trading!

– Erin

erin@decisionpoint.com