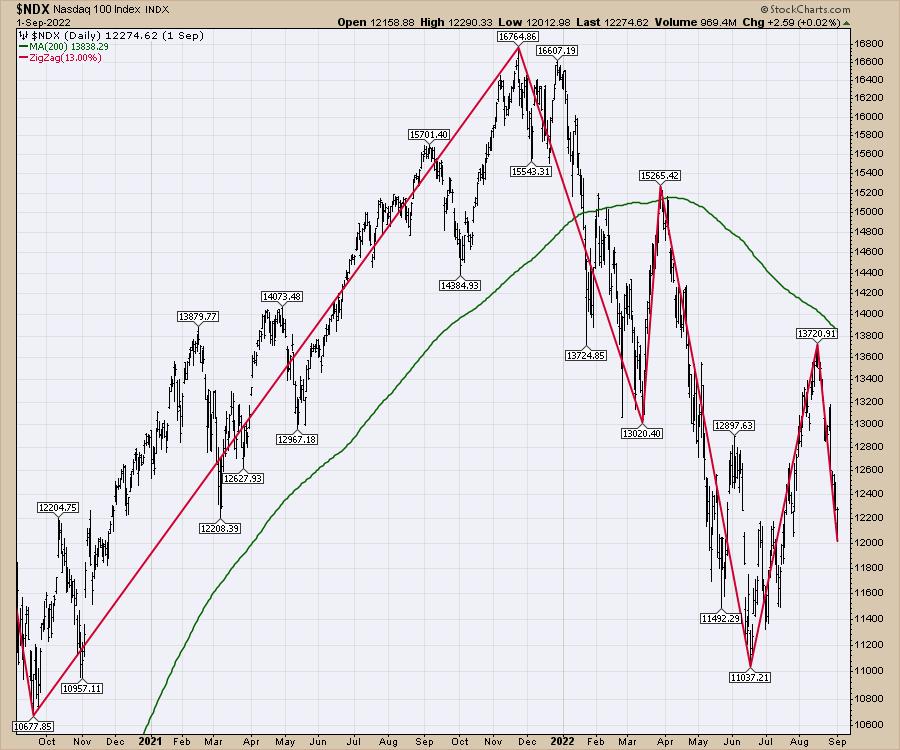

In 2021, the market didn’t have a pullback of 13% before another rally started. In 2022, we have had two now.

This tool is on StockCharts.com. It is called the zigzag. Every time the market reversed positive or negative more than the amount you pick – in this case 13% – it will draw a new trend line.

So after a swift move down of more than 1% per day for a few weeks, can the market make a hard reversal higher?

That is the question!

I keep watching the banks for clues based on the sector rotation model. If this chart rolls over, and the PPO rolls over below zero this is concerning.

The Sector Rotation model suggests that in an early recession, financials should be one of the stronger sectors as the yield spread improves. It would appear we are still in the rapidly rising interest rate environment of the Fed that is in the bottom grid. Meaning the banks will be under pressure until this reverses.

As investors watch for signs of inflation easing, I have this question. Below are pictures of 2022 Mustangs. The black one is a fully loaded EV at $88,000.

The white one is a fully loaded gasoline engine at 58,000.

If EV cars are going to be 50% more and increasing market share every year, how can car inflation drop meaningfully? Since this picture was taken, the Ford CEO said they were going to increase the EV retail price by $8000 to cover ‘rising costs’. Now the EV car will be $38,ooo higher or 65% higher.

A serious question – if the EV costs and EV sale prices are rising so dramatically, and car prices are a big part of the CPI calculation, how does this get anywhere near a 2% rise inflation? Secondly, If EV sales are increasing every year, and gas sales are decreasing, this is going to become an even larger accelerant year over year for inflation. Does the Fed call the CEO’s and ask them to remove the EV car premium?

While we wait for inflation to come down, we are going to have to ask obvious questions about how this example gets to 2% inflation. Until the Fed stops raising interest rates in response to spiralling inflation, are the markets are going to continue to be under pressure? California is outlawing the sale of gasoline powered cars and 4 days later they announce EV charging restrictions due to soaring power demand and lack of supply. If utility bills start rising like they are in the UK, how does inflation come under control? If utility bills start spiralling to keep up with the increased EV sales, how does this level out? If EV production costs are spiralling, how does this cost spiral stop?

I think the banks are going to be a good gauge for the economy, and until they can make the turn higher, we’ll need to remain cautious. Looking at this simple car model, we might be way too early expecting inflation to flatten out.