The company behind Snapchat is making about 1,300 staff redundant and cutting investment in projects such as augmented reality glasses, as the social media business fights an advertising downturn.

Snap’s chief executive said the latest quarterly revenue growth of 8% was “well below” expectations and the company’s planning includes assumptions that a weak advertising market continues into next year.

“Unfortunately, given our current lower rate of revenue growth, it has become clear that we must reduce our cost structure to avoid incurring significant ongoing losses,” said CEO and cofounder Evan Spiegel.

Spiegel told staff the US-based company would cut its 6,400-strong workforce by 20% and stop investment in areas such as mobile games and its drone camera, Pixy. Snap is also closing its Originals division, which has produced content from stars such as Megan Thee Stallion and Anthony Joshua.

The job cuts come after a profit warning in May was followed by disappointing results in July as Snap, which makes more than two-thirds of its revenue in North America, said advertisers were being hit by supply chain disruptions, labour shortages and high inflation.

Privacy changes implemented by Apple have also made it difficult for social media companies to target users with digital advertising or measure its impact.

In a presentation slide for investors accompanying the announcement, Snap said it would be “narrowing” its investment in AR glasses, which overlay digital images on what a wearer sees.

The spectacles, which exist in a prototype form, have been much-heralded by Snap, but the company said it would now focus on long-term research and development for the glasses.

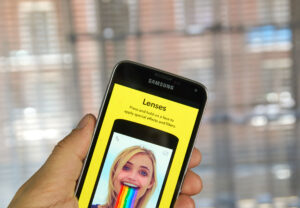

Snap shares rose 9.2% to $10.93 (£9.39) on the news, as investors took reassurance from the company’s decision to pare back investment in some areas of its business. Snap’s messaging app has 347 million users worldwide.

“By going ‘back-to-basics’ and streamlining its focus on to its core product, Snap has a good chance of coming out of this, though it will take time,” said Jasmine Enberg, an analyst at Insider Intelligence, a market research company.

As part of the changes, Snap’s senior vice-president of engineering, Jerry Hunter, will be promoted to a new role of chief operating officer and will be responsible for improving coordination between engineering, ad sales and product teams, Spiegel said.

The company said it would focus on improving sales and the number of Snapchat users. The “clear and defining action” to refocus its business has reassured investors, said Paolo Pescatore, an analyst at PP Foresight.

Analysts and investors have viewed Snap as an early indicator for trends affecting other social media platforms, as Snap is usually first to report quarterly earnings or provide business updates.

If the 8% growth rate flagged in Snap’ statement holds, it would be the slowest Snap has recorded since becoming a public company in 2017 – a far cry from triple-digit growth rates recorded in previous quarters.

Two of Snap’s top ad sales executives – chief business officer, Jeremi Gorman, and vice-president of ad sales, Peter Naylor – are leaving to join Netflix and build the streaming service’s ad business.

Read more:

Snapchat firm cuts 1,300 staff in face of advertising downturn