SPX Monitoring Purposes: Long 8/29/22 4030.61

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78

Long Term SPX Monitor Purposes: Neutral

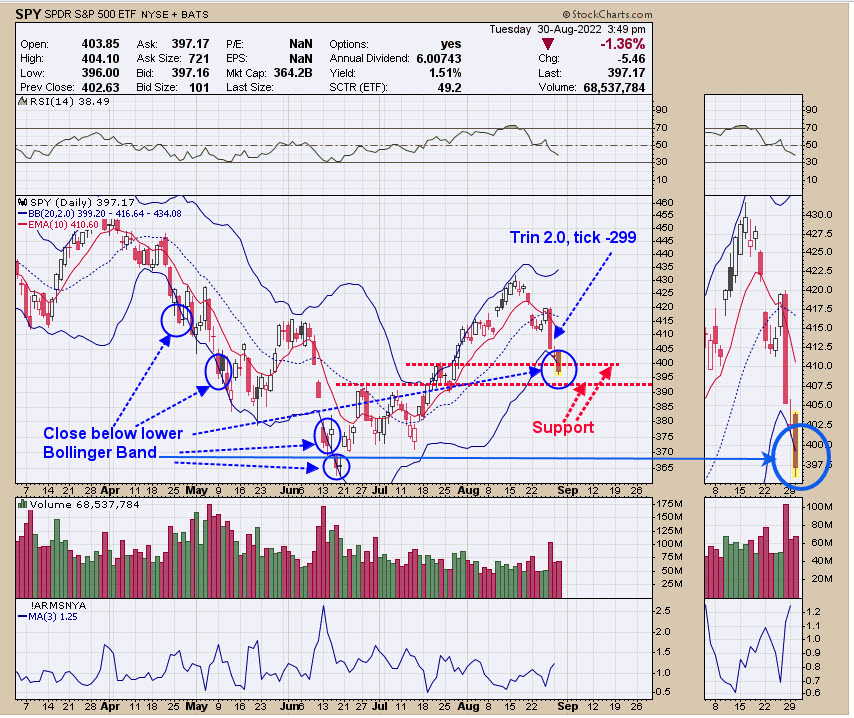

On Friday, the TRIN closed at 2.10 and TICK closed at -299, which is a bullish combination that predicts a low from the same day as the bullish readings to as late as two days later, which would be today. Also on Friday, the SPY had a “Selling Climax” day (volume near double the previous several days’ volume) which shows exhaustion to the downside. Today, the SPY closed below its lower Bollinger Band, and previous examples flipped the market sideways or reversed up. Volume should lighten up starting tomorrow and continue to decrease into Friday, going into a 3-day weekend holiday. Its common for markets to reverse around holiday weekends.

Updated this chart and have nothing new to add. Yesterday, we said, “the second window down from the top is the VIX/VVIX ratio. This indicators can also measure a form of panic by measuring the velocity of this ratio. The top window is the RSI for this ratio; readings above 70 suggest short-term exhaustion. Current reading is 80. Second window up from the bottom is the Percent Bollinger Band; today’s reading is .99, showing that VIX/VVIX ratio is at its upper boundary line and is due for a pause. The red vertical lines shows the times when both RSI and Percent Bollinger Band reached overbought levels. Should see a bounce in the market short-term.”

We updated this chart from yesterday. We want to point out that a new decline in GDX never began when the 18-day averages of the up down volume percent and Advance/Decline percent traded below -20. When the -20 reading was recorded on both indicators, the decline was finished and the base-building process begun. This time could be different, but today’s tests of the July low on GDX should find support and in general continue to go sideways, possibly for several more weeks. This type of setup appears to be working out as the previous signals worked out.

Tim Ord,

Editor

www.ord-oracle.com. New Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable, there is no guarantee results will be profitable. Not responsible for errors or omissions. I may invest in the vehicles mentioned above.