Something’s got to give. After the triple bottom I pointed out in this space last week, the major indexes crossed back above key moving averages, but ran into overhead resistance, despite the market’s breadth improving as liquidity measures pulled back.

The Fed is going to raise interest rates on 7/28/22, perhaps by as much as 1%, although a second sequential 0.75% increase in the Fed Funds rate is the mostly likely outcome. Meanwhile, amid rising expectations that the upcoming U.S. GDP figure will deliver a negative number (signaling an official recession), there are rising signs that the global economy is slowing down. Thus, the stock and bond market are betting that the central bank is almost done raising rates.

Still, in the short-term, that perception may be a risky viewpoint.

Where are We Now?

Last week in this space, I noted “the bearish lower high/lower low trading pattern [in the New York Stock Exchange Advance Decline line, NYAD] has been replaced by what looks to be a triple bottom. The next step, if a longer-lasting bullish trend is to reassert itself, is a sustained move above the 50-day moving average.”

As I further noted, “the S&P 500 (SPX) is also continuing what appears to be a bottoming process, with short-term resistance at 3900 with room to run toward 4000 if the index can remain above 3900. Accumulation Distribution (ADI) is rising, which means short-covering is ongoing. A turn up in On Balance Volume (OBV) would be very encouraging, as it would signal buyers coming in, but it has yet to materialize.”

And so, just a few days before the Federal Reserve’s next rate hike, here’s where we are:

NYAD is above its 50-day moving averageSPX is above 3900 and its 50-day moving average; butOn Balance Volume is still flat although bottoming out, andLiquidity remains sluggish

All of which adds up to what seems to be a huge short squeeze. So again, unless real buyers come in and really assert themselves soon, it leaves the market vulnerable to the Fed.

Corporate buybacks may be part of the fuel behind the current rally. That makes sense because, as we head into the second half of the year, CEO year-end bonuses, which are usually pegged to the price of their company stocks, are in play. Thus, it’s time to crank up the buyback machine so the stock goes up and those year-end bonuses max out.

Liquidity, Liquidity, Liquidity

So it’s still all about liquidity. The Fed has already started QT and, as I noted here last week, when the Fed removes money from the financial system, it leaves big banks like JP Morgan (JPM), Morgan Stanley (MS) and Goldman Sachs (GS) with less money to slosh through their dark pool trades and behind-the-scenes derivative ploys.

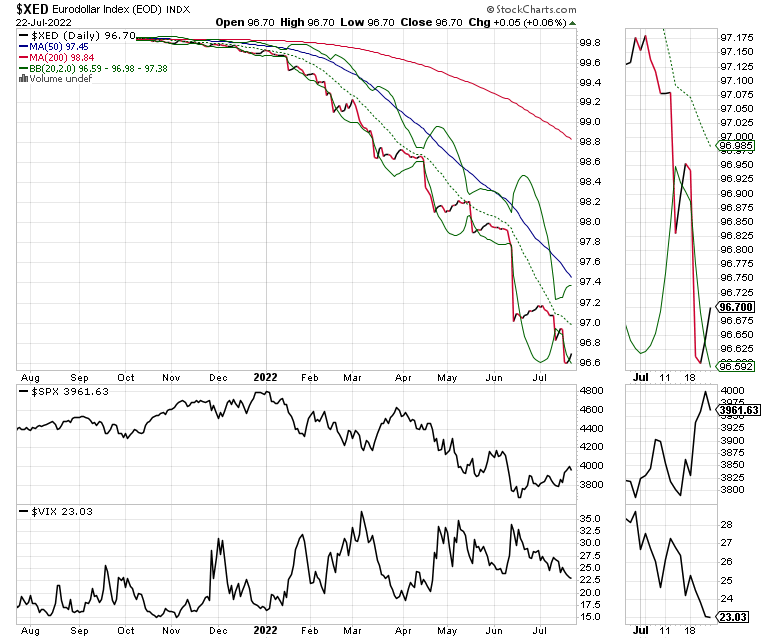

And that’s showing up in the Eurodollar market, which is an excellent gauge of system liquidity. A rise in the Eurodollar Index (XED) means liquidity is ample. Right now, it remains in a downtrend.

This steady decline in the Eurodollar Index (XED) suggests that liquidity is still below par, even though it’s trying to recover. The price area around 97 is a key decision point.

Buy the Dip? D.R. Horton Beats Earnings, Misses Revenues, Guides Lower – Stock Breaks Out

Shares of homebuilder D.R. Horton broke out last week.

The company delivered a mixed headline earnings report on 7/21/22, with a $0.16 cent beat on its earnings and a $110 million revenue miss. But don’t cry in your pretzels for Horton, as revenues came in at a nifty $8.79 billion, which was still a 21% year-over-year growth rate.

Here’s more detail:

Net income and profit margin growth of 48% and 28%, respectivelyNet sales grew by 8%Cash on balance sheet of $1.2 billionRising sales on rental property unit (apartment construction)No reports of supply chain problemsForward guidance reductions of revenues to $33.8-$34.6 billion from $35.3-$36.1 billion projected earlierReduction in forward guidance for homes closed to 83,000-85,000 units from 88,000-90,000 units, andOrders fell by 4% while cancellation rates increased and the order backlog is also fallingBig earnings and rising sales, despite lower home sales volume, means higher sales price per unit

DHI is the market share leader in high growth areas, including Dallas-Fort Worth, Houston, Atlanta and Phoenix, while 50% of its homebuilding revenues came from sales in the Southern U.S. — Southeast (26%), the Southwest (15%) and South Central (11%). The ongoing growth in U.S. population relocation to this geographic region remains favorable for homebuilders.

The shares initially dipped on the guidance news, but, unsurprisingly, rallied into week’s end as the U.S. Ten Year Note yield (TNX) fell below 3%, raising the prospects of at least a short-term dip in mortgage rates.

Shares broke out above $75, a very large resistance level anchored by a broad Volume by Price (VBP) bar, which suggests buyers are starting to overwhelm sellers more convincingly (improving OBV) as short sellers fly the coop (rising ADI). A move toward $82-$85 is not unrealistic here, unless bond yields reverse.

Bond yields collapsed on 7/22 after U.S. PMI Service data fell off a cliff. This was immediately bullish for homebuilder stocks. Demand for new homes in the Southern U.S. remains high, while supply remains tight as homebuilders are not overbuilding yet. Moreover, any slowing in housing at the moment is due to mortgage rates.

All of this means that, as bond yields fall, the odds favor a resurgence of the U.S. housing market, mostly in the southern and sunbelt states as the migration from high tax, high regulation, flailing economy states gathers steam.

I own shares in DHI.

Natural Gas is Still Burning Hot

The back and forth between Russia and Europe with regard to the Nord Stream 1 pipeline continued last week, with the news changing on a daily basis.

Russia turned on the pipeline on 7/22 at 40% capacity, but that may not be enough to replenish European stores for the winter, especially as hot summer temperatures rage. Thus, Europe will still get only a fraction of its normal gas supply for the winter.

In the U.S., supplies are building a bit faster in the last few weeks, but are still behind last year’s pace and well below the five-year average. That means tighter supplies and higher prices ahead. The key price for NATGAS is $8.

Meanwhile, the U.S. Natural Gas ETF (UNG), which I recommended to subscribers before the reversal of the recent price dip, has also been on a tear lately, and looks set to move toward a test of its recent highs.

I own shares in UNG.

Welcome to the Edge of Chaos:

“The edge of chaos is a transition space between order and disorder that is hypothesized to exist within a wide variety of systems. This transition zone is a region of bounded instability that engenders a constant dynamic interplay between order and disorder.” – Complexity Labs

NYAD Above 50-day Line as SPX Tests Resistance at 4000; Liquidity Remains Scarce

The NYAD Advance-Decline line (NYAD) is back above its 50-day moving average, which is bullish if it holds. The major indexes failed on their first attempt to rise above key chart resistance points.

Note that NYAD has been rising even though XED has remained in a downtrend – a sign of fading liquidity. This can’t last forever, which means that either XED turns up or NYAD turns down.

The S&P 500 (SPX) failed on its first run at 4000, but remained above 3900. Accumulation Distribution (ADI) is rising, which means short covering is ongoing. A turn up in On Balance Volume (OBV) would be very encouraging, as it would signal buyers coming in, but it has yet to materialize.

The Nasdaq 100 index (NDX) also crossed above its 50-day moving, but failed on its first try to rise above 12500. Accumulation Distribution (ADI) and On Balance Volume (OBV) are improving.

For more on a risk-averse approach to trading stocks, consider a FREE trial to my service. Click here.

To get the latest up-to-date information on options trading, check out Options Trading for Dummies, now in its 4th Edition – Get Your Copy Now! Now also available in Audible audiobook format!

#1 New Release on Options Trading

Good news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 videos) and a few other favorites public. You can find them here.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe’s exclusive stock, option and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.